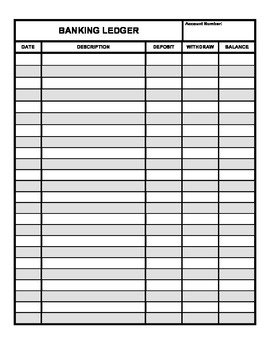

Keeping a record of your banking transactions can help you track your spending, making budgeting a simpler process.If a vendor charges you the wrong amount for a purchase, you may not otherwise know if you don’t balance your account at least once a month. You also can catch merchant errors more quickly if you reconcile regularly.Though rare, banks do sometimes make mistakes, and regularly balancing your checkbook allows you to catch such errors in a timely fashion.Making sure you recorded checks as you wrote them and reconciled your account with the bank’s statement ensured that you were never caught flat-footed when an old check finally cleared. Back when paper checks were more common, it could take quite some time for any one check to clear.There are several reasons for keeping such a record and balancing it regularly: Even today, when much (if not all) of your transaction information is available with the click of a button, it’s still a good idea to maintain a record of your transactions and regularly balance that record.īalancing your checkbook, which is also known as reconciling your account, is basically about making sure that the records you have kept for your financial transactions match those the bank lists on your statement.

0 kommentar(er)

0 kommentar(er)